As with all investments, there is always an element of risk. Even if the interest rates are written into state government law, mandated by state government law, and are regulated by state government law, there is a chance of you losing part or all of your investment. You must always try to get the best education and practice safe investing, no matter which investment vehicle you choose.

Most Recent

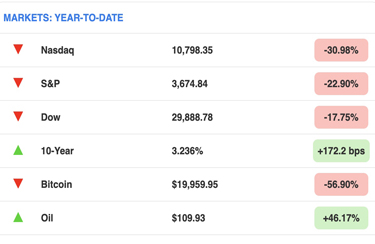

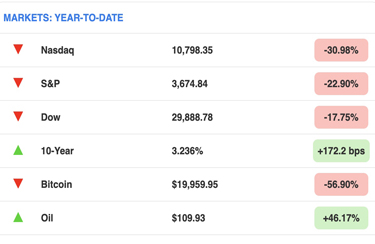

Proactivity is an absolute necessity in today’s economic environment... Financial security, financial stability, and financial dependability are more important today than ever before...

continue reading >>

How to Safely Invest

For our students who are deep into researching tax deed or tax lien properties, they will often stumble across what is generally referred to as a property transfer history. A property transfer history is exactly what it sounds like. You can see record of who the previous owners ...

continue reading >>

Are there Risks?

Tax Lien Certificates and Tax Foreclosed Homes can obviously be extremely lucrative investment strategies; so what are the risk factors one should know about. The more obvious risk factors are: bankruptcy, IRS liens, environmental issues, worthless lands, condemned structures, undesirable neighborhoods, and industrial properties. You may be thinking, “sounds risky.” ...

continue reading >>

Recent Articles

the latest from our experts, click here for the archives...

COVID has been giving all of us headaches for more than a year and half. Whether it’s masks, lockdowns, product shortages, or a crippled supply chain, everyone has been troubled or inconvenienced by the its fallout.

continue reading >>

There’s an old adage in investing that “It take money to make money.” While this is usually true, before you can get the money you need, you must give investors a reason to give it to you.

continue reading >>

The housing market continues to climb as low inventories and high building costs push prices higher. However, the end of the foreclosure moratorium is helping to increase housing inventories and is providing much needed supply for homebuyers

continue reading >>

Rising inflation is front-page news as the prices of commodities, groceries, and especially building materials have been rising drastically. Inflation is the rising cost of goods and services.

continue reading >>

Many real estate investors think these private equity funds are helping feed another real estate market bubble. So, why are private equity firms buying up real estate, and what does it mean for tax lien and tax deed investors?

continue reading >>

Karl W. Smith argued that affordability and stability in housing has come to an end, and people should begin to embrace renting to buying. In 2004, homeownership reached a peak of 69% but has been trending lower.

continue reading >>

Follow the story of a beginner tax lien investor, Ryan, through the Tax Lien Apprentice series.

continue reading >>

Yes! Please send me the FREE 4-Module Masterclass with future training alerts. We respect your privacy and will never rent or sell your information. Ever.

|