|

Written by Tony Martinez |

Tax lien certificates are offered by county governments as a means of collecting delinquent property taxes.

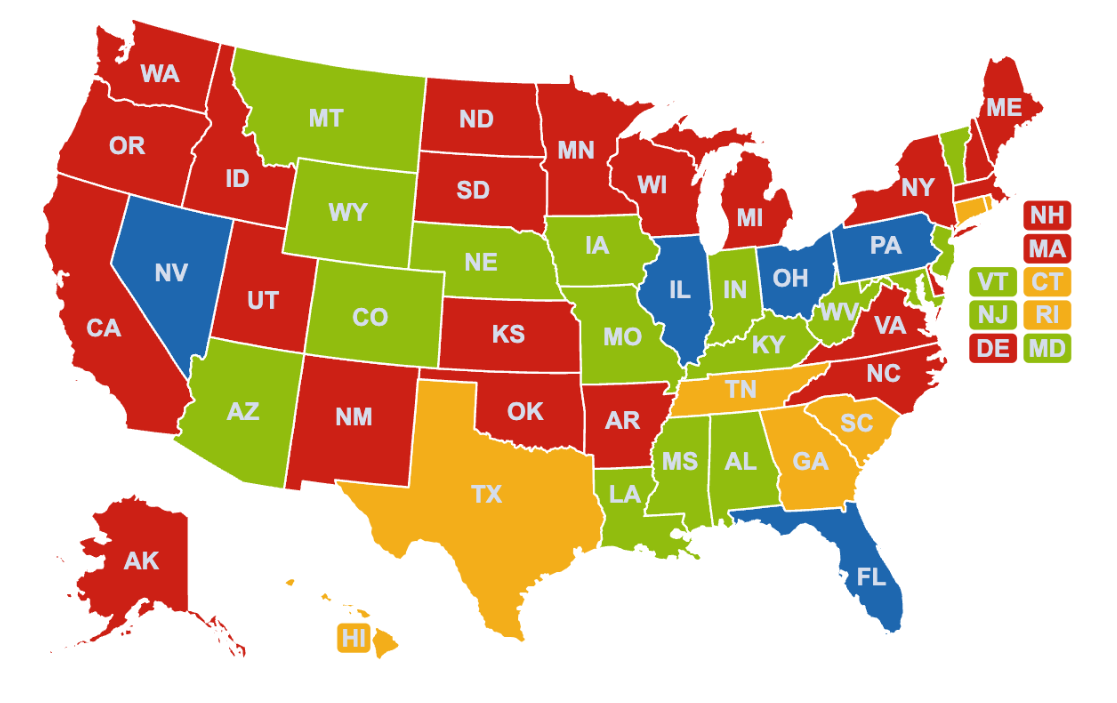

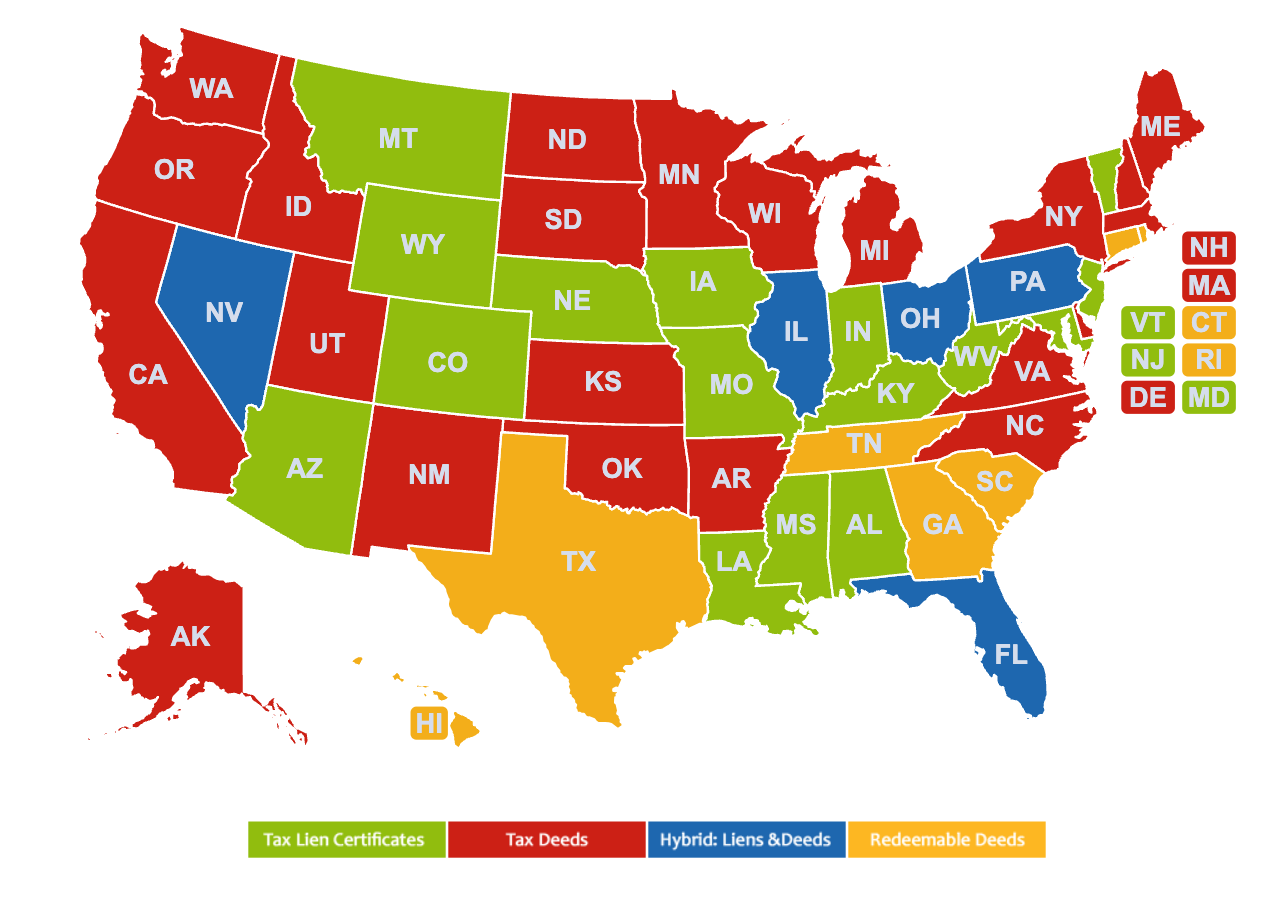

Rather than just give a list of states that offer tax lien certificates, I believe it’s important to understand that all states have a system for collecting delinquent property taxes, whether they offer tax lien certificates or not.There are 3 main types of systems for collecting delinquent property taxes, which are:

- Tax Lien Certificates

- Tax Deed Properties

- Redeemable Deeds

Each state has adopted its own system, and therefore there are tax lien certificate states, tax deed property states, and redeemable deed states.

Each system has its own set of strategies and procedures for investing, whether you’re a beginning or seasoned investor.

For example, some people want to invest to safely earn fixed secured interests rates, while others want to acquire valuable real estate at huge discounts, and those who want to acquire real estate also have different objectives, some want to flip properties for quick profits, while others want to build a portfolio of cashflow properties.

Depending on a person’s investment objective will dictate which type of state to invest in, whether that’s a tax lien certificate state, tax deed property state, or redeemable deed state.

Tax Lien Certificate States

Tax lien certificate states of course offer tax lien certificates, which is a first position lien on real estate due to delinquent property taxes. Tax lien certificates pay fixed secured returns ranging from 8% to 24% interest per year depending on the state you invest in.

Once a property owner is one year delinquent on their property taxes, the county government will offer a tax lien certificate on the property. When you invest in a tax lien certificate, in essence, you’ve paid someone else’s delinquent property tax bill for them, and in return you receive a tax lien certificate that is recorded against the property exactly like a mortgage with the exception that your tax lien certificate takes precedence over the mortgage, which means by law you’re paid first.

Tax lien certificates have a redemption period, which is the grace period the property has to pay their delinquent property tax bill. Redemption periods range from 6 months on the low side to 4 years on the high side depending on the state.

It’s important to note that when you acquire a tax lien certificate, you are simply a lien holder and have no ownership or possession rights to the property.

Tax Lien Certificate Investing is not a Strategy to Acquire Real Estate

Contrary to misinformation by many sources on the internet, investing in tax lien certificates is not a strategy to acquire real estate, it’s a strategy to safely earn fixed secured interest rates ranging from 8% to 24% interest per year.

Acquiring valuable real estate at massive discounts due to delinquent property taxes requires a different set of strategies, which include The U.S. Tax Lien Association’s proprietary “Get the Property” Strategies like:

- SCS Acquisitions

- Tax Resale Property Acquisitions

- OTC – TDP Acquisitions

- Foreclosable Tax Lien Acquisitions

Additionally, Tax Deed Property States and Redeemable Deed States offer an opportunity to acquire real estate due to delinquent property taxes.

Tax Deed Property States

Tax deed property states do not offer any sort of tax lien certificate, therefore there’s no way to earn secured fixed interest in tax deed states.

When you invest in a tax deed property state, you’re investing to acquire the property.

Each tax deed state has its own set of rules regarding their tax sales, but in general, properties are not put up for tax sale until the property taxes are five years delinquent, which in gives the property owner five years to pay their delinquent property taxes.

Properties are offered via public auction, and in general the opening bid is the amount of the back taxes, penalties, and interest. It’s a competitive bidding procedure with the highest bidder winning the rights of ownership to the property.

In general, you take immediate ownership of the property, and there’s no redemption period.

Laws, rules, and regulations regarding tax deed properties and tax sales vary greatly from state to state and it’s critical to have a thorough understanding before investing in tax deed property states.

Redeemable Deed States

A redeemable deed state is somewhat of a hybrid between a tax lien certificate and a tax deed property state.

Redeemable deeds are offered via public auction in a competitive bid process.

The successful bidder wins the deed to the property, but the deed is subject to a redemption period.

In redeemable deed states, redemption periods range from 6 months to 2 years depending on the state.

Redeemable deeds pay a flat penalty interest if the property owner redeems.

It’s important to note that there are 2 types of redeemable deed states:

- Allowed to take possession of the property during the redemption period.

- Not allowed to take possession of the property during the redemption period.

In “take possession redeemable deed states,” for the property owner to redeem, they must not only pay the amount the investor paid for the property at auction, but they must also reimburse the investor for all renovation expenses and pay the penalty interest on the entire amount.

In redeemable deed states, it’s highly unlikely the property owner redeems, so it’s important to complete thorough research assuming property ownership.

Redeemable Deeds – Possession Not Allowed During Redemption Period

In redeemable deed states that do not allow investors to take possession during the redemption period, the investor must treat the investment like a tax lien certificate, which means they can’t possess the property, or even walk onto the property.

Investors must wait to see if the property owner redeems, which again is highly unlikely, which also means they will have to wait the entire redemption period to take possession, which is typically 1 year for “non-possession redeemable deed states.”

Summary

As you can see, it’s important to know more than the answer to the question, “which states offer tax lien certificates?”

Generally speaking, under the broad term “Tax Lien Investing,” there are 2 main investment objectives:

- Safely earning fixed secured interest rates ranging from 8% to 24% interest per year. Acquiring valuable real estate at huge discounts and owning them free and clear with no mortgage.

Tax Lien Certificate, Tax Deed Property, & Redeemable Deed States

For a comprehensive overview of how to invest in Tax Lien Certificates, as well as USTLA’s proprietary “Get the Property” Strategies, where you can acquire valuable real estate for the price of the back taxes, penalties, and interest, please enroll for our self-paced FREE Online Video 3-Module Tax Lien Investment Crash Course and start learning from the comfort of your own home today.