|

Written by Tony Martinez |

Real estate tax lien investing could be the #1 strategy for helping people achieve ultimate financial security, especially if you’re starting with limited capital.

What is exactly is a tax lien certificate?

A tax lien certificate is a first position lien on real estate due to delinquent property taxes. Once a property owner is one year delinquent on their property taxes the county government will offer a tax lien certificate for sale on the property, which gives the county a predictable necessary revenue source to fund vital services.

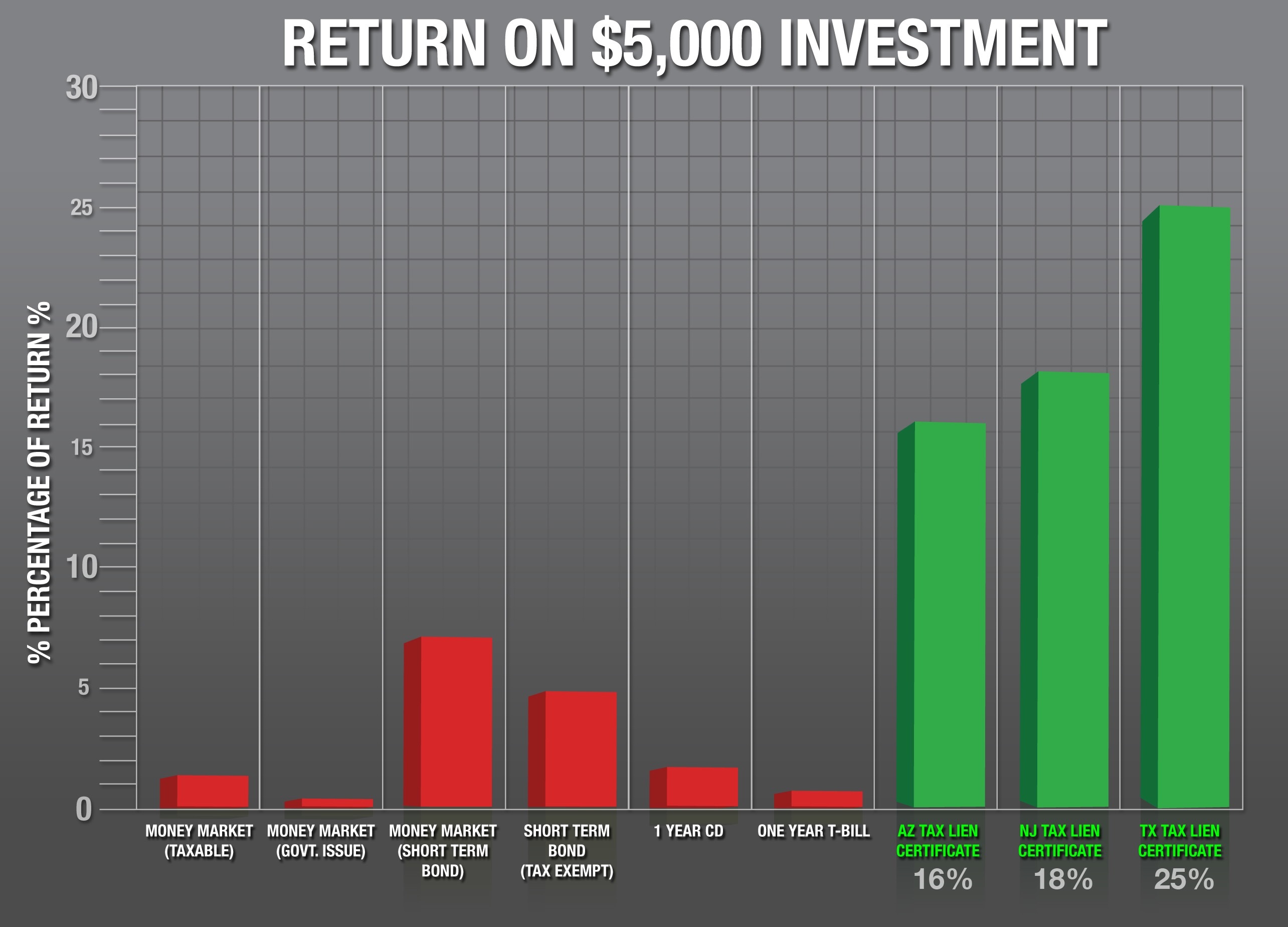

Tax Lien Certificate Investors Safely Earn Fixed Secured Returns of 8% to 24% per Year

The investment for the tax lien certificate is the price of the back taxes, penalties, and interest owed. When investors acquire tax lien certificates, they give the county the necessary revenue to operate and fund vital community services, like police departments, public schools, fire departments, hospitals, parks & recreation departments, and roads. In return, the investor earns a very attractive fixed secured interest rate ranging for 8% to 24% per year depending on the state.

Tax Lien Certificates are Recession Proof with No Volatility

Tax lien certificates pay fixed secured interest rates, which means they do not fluctuate with the stock market, real estate market, or the economy.

For example, tax lien certificates in Iowa pay a maximum of 24% interest per year, while Indiana pays a maximum of 15% interest per year.

Exactly like a bank CD, once you make your investment, you’re locked in at that interest rate, and therefore can’t be impacted by the volatility of the markets or economy.

For example, if you acquired an Iowa tax lien certificate at 24% interest, no matter what happens in the markets or economy, you’re locked in at 24%. If the stock market crashes, your tax lien certificate still pays you 24%. If the real estate market crashes, your tax lien still pays you 24%. If we fall into a recession, your tax lien still pays you 24%. If a worldwide pandemic hits, your tax lien certificate still pays you 24%.

Tax Lien Certificates take Priority Over the Mortgage

Additionally, when you acquire a tax lien certificate, your lien is recorded against the property like a mortgage, with the exception that by law your tax lien certificate takes precedence over the mortgage and can even extinguish the mortgage in property tax foreclosure.

The underlying property acts as security for your investment, and unlike a mortgage, property taxes only account for a small fraction of the value of the property, which gives you an extremely high degree of safety.

Tax Lien Certificate Investing is a Win-Win-Win for:

- Local Communities

- The Property Owner

- The TLC Investor

Tax Lien Certificate Investing Helps Local Communities

Property taxes remain the most important revenue source for any county. As mentioned, property tax revenue pays for vital services like public school systems, police departments, fire departments, paramedic & ambulance services, parks & recreations, libraries, roads, and local community colleges.

When property taxes go unpaid, it poses a real challenge to counties that must provide these vital services to their communities. By offering tax lien certificates, counties generate the necessary revenue to operate effectively.

The Tax Lien Certificate Investor Wins

For as long as property taxes have existed, there has always been a method for collecting delinquent property taxes. The tax lien certificate system gives a win-win-win situation between the county, the property owner, and the tax lien investor.

When you acquire a tax lien certificate, in essence what you’ve done is paid someone else’s delinquent property taxes, and in return you receive the tax lien certificate, which is recorded against the property just like a mortgage.

As mentioned, by law, your tax lien certificate is a first position lien on the property and takes precedence over the mortgage, which means your tax lien certificate is first in line to get paid. The property can’t be sold, refinanced, transferred, or borrowed against until your tax lien investment is paid first with your penalty interest rate (principle plus interest).

The tax lien certificate has a redemption period. The redemption period is the grace period the property owner has to pay their delinquent tax bill. Redemption periods range from 6 months to 4 years depending on the state you’re investing in.

The interest rates that tax lien certificates pay are set by state law and written into the property tax code. So in Iowa, tax lien certificates pay a maximum of 24% interest per year because it’s the law, and that goes for all states that offer tax lien certificates.

It’s important to note that tax lien certificate investors do not cause a 24% per year interest penalty on the property when they acquire the tax lien certificate, the property owner is assessed the same penalty for being late whether we acquire the tax lien certificate or not. So, either we earn the 24% interest or the 24% goes to the county.

The Property Owner Wins

When a tax lien certificate is offered on a property, the property owner has already been delinquent on their property taxes for one year. When we acquire the tax lien certificate, the property owner is given an additional redemption period (grace period) to pay their delinquent property taxes.

Continuing our Iowa example, Iowa tax lien certificates have a 2-year redemption period, therefore, the property owner is given an additional two years for a total of three years to pay their delinquent property tax bill without any danger of losing their property. Some states offer an additional 1 year, while others give 2, 3, or 4 additional years.

When we invest in tax lien certificates, we give the property owner an additional 1 to 4 years of time to pay their property taxes after they’ve already been delinquent for 1 year, for a total of 2 to 5 years, which is a great advantage for the property owner.

I know of no other bill, creditor, or debt that allows for 2 to 5 years delinquency without foreclosure, repossession, or discontinuance of service. In most states, banks can begin the foreclosure process on mortgages after only 4 months of delinquency. The tax lien certificate system gives property owners the fairest amount of time possible to pay their property taxes.

It’s important to note that tax lien certificates are available on every type of real estate, including houses, apartment buildings, duplexes, triplexes, 4-plexes, condominiums, townhouses, office buildings, raw land, car washes, industrial properties, hotels & motels, strip malls, storage units, warehouses, RV parks, agricultural land, restaurants, and any other category of real estate.

High Yields + Ultimate Security for Tax Lien Certificate Investors

Since property taxes are based on a small percentage of the assessed value of the property, the investment for a tax lien certificate is a small fraction of the value of the property. Property tax rates range from approximately .5% to 2.5% of the assessed value of the property depending on the state and county you’re investing in.

For example, the property tax rate in Colorado is .5% of the assessed value, therefore one year’s property taxes on a $200k property in Colorado would be $1,000. If a tax lien certificate was offered on the property, the investor would pay the county $1,000 and would become the first position lien holder and the $1,000 investment would be secured by the $200k property.

Colorado tax lien certificates currently pay 17% interest per year, therefore when the property owner pays their delinquent tax bill, they must pay the county the $1,000 principal investment plus 17% interest. The county processes the payment and sends the investor their original investment (principal) plus the 17% interest. As mentioned, the property cannot be sold, refinanced, transferred, or borrowed against until the investor is paid their original investment plus the 17% interest.

Since the investment for a tax lien certificate is based upon the value of underlying property, tax lien certificates are available from just a few hundred dollars, and for as much as tens of thousands, and even hundreds of thousands of dollars.

Tax lien investing provides a unique and special opportunity for both large and small investors.

What Happens if the Property Owner Does Not Redeem the Tax Lien Certificate

What happens if the property owner doesn’t pay their delinquent property taxes during the redemption period? Once again, your investment is secured by the property and protected by property tax law. If the property does not redeem, by law you can foreclose through property tax foreclosure and take title to the property. Remember, tax lien certificates are a first position lien, therefore they take precedence over any other liens including the mortgage. By law, when property tax foreclosure is complete, all liens junior to the property tax lien are extinguished from the property and are not your responsibility.

When you invest in a tax lien certificate, there is only one of two actions that can take place, either the property owner pays the delinquent tax bill, or they don’t. If they do, you receive your original investment back plus your high fixed secured interest rate, if they do not, you have the right to take title to the property.

What Beginning Tax Lien Investors Must Know First

#1: Homeowners most always pay their delinquent property tax bill. People simply do not lose their home for a few hundred or a few thousand dollars in back taxes. Given the low amount owed in property taxes compared to the value of the property, and the extra time given to pay their delinquent tax bill (1 to 4 years), homeowners most always find a way to pay their property taxes. In a worst-case scenario, they could always sell their property rather than lose it for a few thousand dollars in back taxes.

#2: You must know what you’re doing. Like any other investment strategy, to be successful, you must know what you’re doing. Investing in tax lien certificates isn’t as simple as just getting a list and investing in anything on the list. Quite the opposite, obtaining the list requires almost no skill at all. Lists of tax lien certificates are available to the public and always have been.

Knowing how to conduct proper research specific to tax lien certificates to locate, identify, and acquire highly profitable tax lien certificates on properties of high value is an absolute necessity.

Remember, tax lien certificates are available on every type of real estate including derogatory and worthless properties.

If you’ve been wondering as you read this article why everybody doesn’t invest in tax lien certificates, you just learned why. Tax lien certificate investing requires a specific type of research and is a completely different process than conventional real estate investing. It’s not more complex, it’s just a different set of rules.

For additional information on investing in tax lien certificates, tax deed properties, redeemable deeds, and the proprietary strategies we’ve developed over our 30+ years of expert experience, please explore our free training resources on this website.