|

Written by Tony Martinez |

I know one of the attractive features of tax lien investing can be the “low price of entry.”

Yes, there are tax lien certificates available for only $500, $200, $100, and even $50.

Although it’s true that you can start investing in tax lien certificates and tax deed properties with only a few hundred dollars, I believe it’s important to address investment capital with a much more comprehensive explanation so you can get started right.

Setting the Record Straight on Tax Lien Investing & Investment Capital Needed to Get Started

The reason this detailed explanation is important is because of the volume of misleading, inaccurate, and false information on the internet regarding tax lien investing, which can cause false expectations and discourage new tax lien investors.

Here at The U.S. Tax Lien Association (USTLA), we pride ourselves on a straightforward, no nonsense, evidence based approach to successful tax lien investing because we know how important financial freedom is to our valued clients.

It’s important to remember that property taxes are based upon the value of the property. The higher the value of the property, the higher the property taxes, which means the higher the investment for the tax lien certificate.

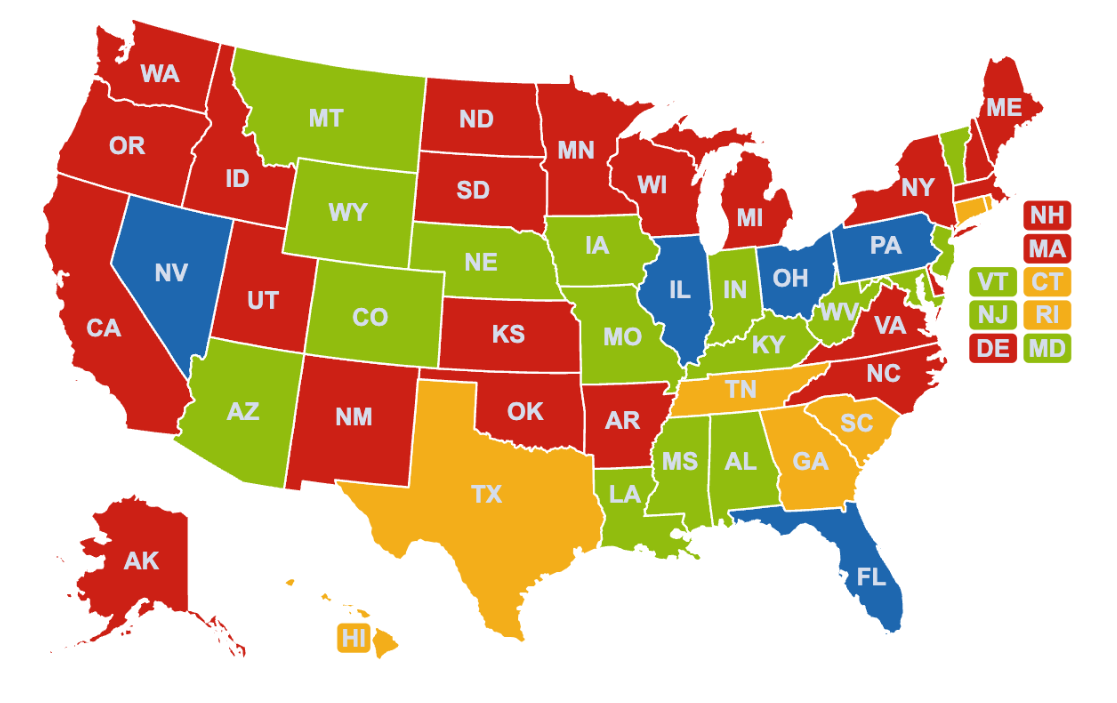

It’s also important to re-establish that there are 3 Main Delinquent Property Tax Systems for collecting delinquent property taxes depending on the state:

- Tax Lien Certificates

- Tax Deed Properties

- Redeemable Deeds

For a detailed explanation of these 3 Delinquent Property Tax Systems, please see my Featured Lesson Article: “Which States Offer Tax Lien Certificates?”

How the Price of a Tax Lien Certificate is Determined

In general, in a Tax Lien Certificate State, once a property owner is one year delinquent on their property taxes, the county government is going to offer a tax lien certificate on the property, therefore the investment to acquire the tax lien certificate is the amount of one year’s delinquent property taxes, plus penalties and interest.

Property values of course vary greatly state to state, county to county, city to city, and neighborhood to neighborhood.

So, it is possible to begin investing in tax lien certificates with just a few hundred dollars, but the more important question becomes:

- Can you build true wealth investing just a few hundred dollars in a tax lien certificate?

In my experience the answer is not exactly, whether it’s tax lien investing or any other strategy.

The value of getting started with just a few hundred dollars is learning and mastering the skillset of successful tax lien investing so it can lead to financial freedom.

Acquiring Real Estate through Tax Lien Investing for Only $500

We here at USTLA have acquired properties for as little as $500, and we have clients who have acquired houses for as little as $500, but I wouldn’t say that it’s the norm.

Here are a couple houses that were acquired by our valued clients for only $500:

Proper Research is the Answer

It’s also important to remember that just because a tax lien certificate or a tax deed property can be acquired for only $500 doesn’t mean it’s worth acquiring. Successful tax lien investing is dependent upon knowing how to complete proper and thorough research specific to tax lien investing so you avoid acquiring tax lien certificates on derogatory or worthless properties.

In our over 32+ years of expert experience, building true wealth does not stem from investing a couple of hundred dollars in a tax lien certificate, it’s the result of acquiring valuable real estate at massive discounts, which almost never happens from investing in a “tax lien certificate.”

Yes, you can acquire valuable real estate at massive discounts due to delinquent property taxes, but it’s not from investing in “tax lien certificates.”

Acquiring the property for the prices of the back taxes, penalties, and interest only requires specific types of strategies, which I discuss later in this lesson.

NEWS FLASH: “Tax Lien Certificates” Do Not Lead to Getting the Property

For the record, tax lien certificates are an extraordinary investment vehicle for safely earning fixed secured returns with maximum interest rates ranging from 8% to 24% interest per year, but they’re not a good investment vehicle for acquiring real estate at massive discounts and owning the property free and clear with no mortgage.

I know, you’ve probably heard or read elsewhere that when you invest in a tax lien certificate, you either earn the fixed secured interest rate or you get the property, which is true, but what is almost never revealed is that tax lien certificates on a person’s home almost always redeem, which means you don’t get the property.

Waiting 1 to 4 Years to Acquire the Property Does Not Make Sense

Additionally, redemption periods for tax lien certificates range from one year to four years, which means you’d have to wait one to four years minimum to acquire the property. Investing in a tax lien certificate and waiting one to four years hoping the property owner doesn’t redeem is not an effective real estate acquisition strategy, especially if you want to start making money and building wealth now.

Getting the Property Creates Wealth

Here at USTLA, our highest level of expertise is acquiring valuable real estate at massive discounts through the power of tax lien investing. Over the past 32+ years, we’ve developed several proprietary “Get the Property” tax lien investment strategies for acquiring real estate at massive discounts, which are not the result of acquiring a tax lien certificate and waiting several years to acquire the property.

USTLA’s proprietary “Get the Property” strategies give you the opportunity to acquire the property at a deep discount, take immediate possession of the property without waiting a redemption period, and then either sell the property for a profit, or rent for a consistent predictable monthly cashflow.

Here are 2 recent examples of “sell as is” quick flips:

Purchase price: $7,560

Purchase price: $7,560Sale price: $40,000

Purchase Price: $15,700

Purchase Price: $15,700Sale Price: $30,000.00